Services

NEFT/RTGS Facilities

National Electronic Funds Transfer (NEFT) is a nation-wide payment system facilitating one-to-one funds transfer. Under this Scheme, individuals, firms and corporates can electronically transfer funds from any bank branch to any individual, firm or corporate having an account with any other bank branch in the country participating in the Scheme. Individuals, firms or corporates maintaining accounts with a bank branch can transfer funds using NEFT. Even such individuals who do not have a bank account (walk-in customers) can also deposit cash at the NEFT-enabled branches with instructions to transfer funds using NEFT. However, such cash remittances will be restricted to a maximum of Rs.50,000/- per transaction. Such customers have to furnish full details including complete address, telephone number, etc. NEFT, thus, facilitates originators or remitters to initiate funds transfer transactions even without having a bank account.

Transaction Alert

Janata Bank is continuously endeavoring to provide hi-tech innovative solutions to meet customers’ requirements. Moving a step further in this direction, we are pleased to announce the launch of Transactional Alert Facility, effective June 1, 2010. Under this facility all account holders shall be sent 24/7 alerts through SMS/Email regarding various activities. Transactional Alert is a hassle free automated facility to keep all account holders updated regarding activities relating to their accounts, including debit/ credit transactions of value Rs 100 and above. The prime objective of this facility is to further empower our customers to feel secure and stay in full control of their accounts. To ensure correct/safe delivery of Transactional Alerts, all account holders are advised to reconfirm/update their mobile numbers/email address and fill the attached “Contact Details Update Form”. This facility is provided to all account holders, against a nominal fixed monthly fee of Rs 60 plus Excise Duty.

Locker Facilities

Nomination on safe-deposit lockers enables Janata Bank to release the contents to the nominee of the person hiring in the event of their death. If a locker is held jointly, and one of the people hiring dies, the contents can only be removed jointly by the nominee(s) and the survivors. The nomination facility is available to anyone hiring a locker. For those hiring on an individual basis; nomination can be made in favour of one individual, For those hiring jointly: nomination can be made in favour of two individuals . In order to facilitate easy and hassle free locker rent recovery, we recommend that a Savings or Current account be linked to the locker. Lockers can be allotted individually as well as jointly. The Locker holder is permitted to add or delete names from the list of persons who can operate the Locker or have access to it. Loss of key is to be immediately informed to the locker branch.

Loan Facilities

Borrowing by way of a loan can provide a company with a flexible and reliable source of funds and allow diverse methods of borrowing capital. An overdraft facility (or working capital facility) is a tool to aid cash flow management by providing a reserve of easily accessible money to meet any shortfall in working capital. An overdraft is usually an uncommitted facility, which means that the lender/bank is not obliged to lend money to the company, and is on demand, which means that it must be repaid whenever the bank demands, even if the borrower is not in default of the terms of the overdraft.

Another common type of loan facility is the revolving credit facility, which combines the elements of an overdraft and a term loan in that the borrower may draw down and repay tranches up to a maximum amount of capital whenever it chooses during the term of the loan, and amounts repaid can be re-borrowed. Syndicated loan facilities are facilities granted by a group of banks (known as a syndicate) to the borrower under the terms of one agreement.

DD(Demand Draft) Facilities

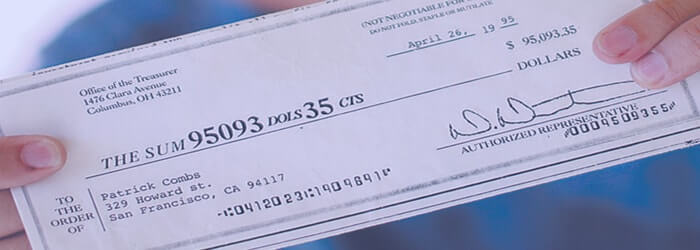

Demand Draft is way for remitters to transfer money A demand draft is more secure than a normal cheque as it can only be credited to a specific payees account, and a customer can only be reimbursed under indemnity if the draft is lost or stolen. A demand draft can also be compared to a cheque. However, demand drafts are difficult to countermand. Demand drafts can only be made payable to a specified party, also known as pay to order. But, cheques can also be made payable to the bearer. Demand drafts are orders of payment by a bank to another bank, whereas cheques are orders of payment from an account holder to the bank.

Demand drafts are also known as sight drafts, as they are payable when presented by sight to the bank. Under UCC 3-104, a draft has been defined as a negotiable instrument in the form of an order. The person making the order is known as the drawer and the person specified in the order is called the drawee, as defined in the UCC 3-103. The party who creates the draft is called the maker and party who is order to pay is called the drawee.

MISS CALL ALERT SERVICS

Know your Account Balance Through Missed Call

Bank has introduced the MISSED CALL Facility, for the benefit of customers whose mobile numbers are registered in SMS Alert With this facility, the customer has to call on 08030636266 from the registered mobile On dialing the number, the call will get automatically disconnected after 2 rings. The customer will receive SMS messages for the all operative accounts The advantage with the facility is that there is no charge for the calls and the customer will receive the information for all operative accounts with a single misssed call.

The customer need not visit the branch just to know the balance details. Note :- If you are not registered for SMS Alert Facility than you do not receive the massage, so you should first register mobile no. at branch for use Missed Call Facility

E statement

An e-Statement is an electronic mail notification sent to your e-mail address the day your statement is available to view in Email . The e-Statement will replace your current paper statement, providing you immediate access to your account information.

You may enroll in e-Statements by logging into Email .

ATM Services

ATM full form is Automated Teller Machine which is a self-service banking outlet. You can withdraw money, check your balance, or even transfer funds. Different banks provide their ATM services by installing cash machines in different parts of the country.

NACH Services

NACH Credit is an electronic payment service used by an institution for affording credits to a large number of beneficiaries in their bank accounts for the payment of dividend, interest, salary, pension etc. by raising a single debit to the bank account of the User Institution (Corporate registered for NACH Services)

IMPS Services

IMPS provides robust & real time fund transfer which offers an instant, 24X7, interbank electronic fund transfer service that could be accessed on multiple channels like Mobile, Internet, ATM, SMS. IMPS is an emphatic service which allow transferring of funds instantly within banks across India which is not only safe but also economical. Currently on IMPS, 677 members are live which includes banks & PPIs.