Department

Head Office

The Department of Banking Supervision at present exercises the supervisory role relating to commercial banks in the following forms: Preparing of independent inspection programmes for different institutions. Undertaking scheduled and special on-site inspections, off-site surveillance, ensuring follow-up and compliance. Determining the criteria for the appointment of statutory auditors and special auditors and assessing audit performance and disclosure standards. Dealing with financial sector frauds. Exercising supervisory intervention in the implementation of regulations which includes – recommendation for removal of managerial and other persons, suspension of business, amalgamation, merger/winding up, imposition of penalties.

Key Member : Mr. Vilas K. Ingole (Accountant)

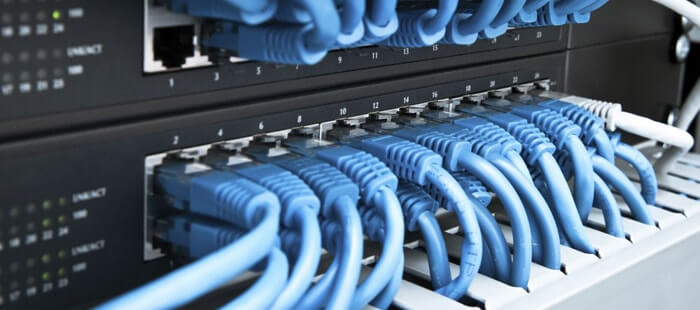

Information Technology

The Information Technology Department ensures that the efficiency and effectiveness of the Bank’s functions and operations are enhancing through the strategic use of information technology. The Information Technology Department performs these core functions: Introduces and maintains computerized information systems to process data efficiently to produce useful and timely information Provides the appropriate hardware, software, networking and communications infrastructure for automation Provides the highest level of data security, confidentiality and integrity Ensures a safe and reliable computing environment Provides a high degree of availability and recovery of its systems.

Key Member : Mr. Ashish R. Parteti (IT - Head)

LoanDepartment

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations etc. The recipient (i.e. the borrower) incurs a debt, and is usually liable to pay interest on that debt until it is repaid, and also to repay the principal amount borrowed.

The document evidencing the debt, e.g. a promissory note, will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower.

Key Member : Mr. Dinesh N. Bhopale (Loan Officer)